tax liens colorado adams county

Go to dmvcoloradogov for more information on Specific Ownership Tax. Be sure to use the State of Colorados official websites of dmvcoloradogov or mydmvcoloradogov.

Bid4assets Adams County Sheriff Real Property Foreclosure Auctions

LibriVox is a hope an experiment and a question.

. Travis County collects on average 198 of a propertys assessed fair market value as property tax. Montgomery County collects on average 175 of a propertys assessed fair market value as property tax. Tax records in Colorado are a crucial component of information for many local government agencies.

The median property tax in Washington County Pennsylvania is 1532 per year for a home worth the median value of 130300. Via the black drop box located outside the main entrance of the Government Center. The median property tax in Jefferson County Kentucky is 1318 per year for a home worth the median value of 145900.

Washington County has one of the highest median property taxes in the United States and is ranked 749th of the 3143 counties in order of. Adams County Property Search. The median property tax in Travis County Texas is 3972 per year for a home worth the median value of 200300.

Jefferson County District Court 100 Jefferson County Parkway Golden CO 80401 Phone. Once the vehicle reaches 10 years of age your Specific Ownership Tax will be 300. Fairfax County collects on average 089 of a propertys assessed fair market value as property tax.

Thats one of the highest median payments of any of the states 64 counties. The median property tax in Mohave County Arizona is 916 per year for a home worth the median value of 170600. All Florida counties offer an online searchable database whereby searches can be performed by document type instrument number name date or address.

Adams County has one of the highest median property taxes in the United States and is ranked 701st of the 3143 counties in order of median property taxes. South Carolina is ranked 1168th of the 3143 counties in the United States in order of the median amount of property taxes collected. Chester County collects the highest property tax in Pennsylvania levying an average of 125 of median home value yearly in property taxes while.

The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Also in the event of a foreclosure your tax lien results in you successfully acquiring the property. Jefferson County collects on average 09 of a propertys assessed fair market value as property tax.

The median property tax in Cuyahoga County Ohio is 2649 per year for a home worth the median value of 137200. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. Pennsylvania is ranked 13th of the 50 states for property taxes as a percentage of median income.

Danny Crank Butler County Recorder. The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800. Ellis County collects on average 184 of a propertys assessed fair market value as property tax.

The median property tax in Marion County Indiana is 1408 per year for a home worth the median value of 122200. LaSalle County collects on average 21 of a propertys assessed fair market value as property tax. The exact property tax levied depends on the county in Pennsylvania the property is located in.

Montgomery County has one of the highest median property taxes in the United States and is ranked 407th of the 3143 counties in order of. Administration Building 130 High Street 2nd Floor - Hamilton OH 45011 Phone. The median property tax in Montgomery County Ohio is 2079 per year for a home worth the median value of 119100.

Note for all online transactions. Cuyahoga County collects on average 193 of a propertys assessed fair market value as property tax. The median property tax in Ellis County Texas is 2501 per year for a home worth the median value of 136100.

Fairfax County has one of the highest median property taxes in the United States and is ranked 41st of the 3143 counties in order of median property taxes. Kentucky is ranked 1004th of the 3143 counties in the United States in order of the median amount of property taxes collected. Charleston County collects on average 05 of a propertys assessed fair market value as property tax.

Ellis County has one of the highest median property taxes in the United States and is ranked 280th of the 3143 counties in order of median property taxes. Comal County collects on average 148 of a propertys assessed fair market value as property tax. In addition to the district and county court Jefferson is home to multiple municipal court which preside over ordinance violations small claims and other cases.

Indiana is ranked 890th of the 3143 counties in the United States in order of the median amount of property taxes collected. Can the net harness a bunch of volunteers to help bring books in the. Arizona is ranked 1632nd of the 3143 counties in the United States in order of the median amount of property taxes collected.

Records kept include deeds mortgage documents easements and liens. Top City Brighton. The taxes gathered from real property and other properties are the primary income source for these regions.

The median property tax in LaSalle County Illinois is 2632 per year for a home worth the median value of 125500. The median property tax in Charleston County South Carolina is 1205 per year for a home worth the median value of 242100. Boulder Countys average effective property tax rate is 0.

Cook County collects on average 138 of a propertys assessed fair market value as property tax. Washington County collects on average 118 of a propertys assessed fair market value as property tax. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

Cuyahoga County has one of the highest median property taxes in the United States and is ranked 241st of the 3143 counties in order of median property taxes. The typical homeowner in Larimer County can expect to pay about 1808 in property taxes annually. Marion County collects on average 115 of a propertys assessed fair market value as property tax.

Travis County has one of the highest median property taxes in the United States and is ranked 69th of the 3143 counties in order of median property taxes. The median property tax in Comal County Texas is 2782 per year for a home worth the median value of 187400. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner.

The median property tax in Adams County Colorado is 1593 per year for a home worth the median value of 196100. In July 2021 the Treasurer sent out approximately 10000 Delinquent Tax Notices. If you received a Delinquent Tax Notice and believe that your taxes have been paid in full please call 7205236160.

Adams County collects on average 081 of a propertys assessed fair market value as property tax. Residential or commercial property taxes are a levy weighed on the land structures. Adams County Pkwy Brighton.

The average effective tax rate in Jefferson County is 055. LaSalle County has one of the highest median property taxes in the United States and is ranked 246th of the 3143 counties in order of median property taxes. Deed and other document recording is managed by the County Clerk in each county.

Mohave County collects on average 054 of a propertys assessed fair market value as property tax. Comal County has one of the highest median property taxes in the United States and is ranked 201st of the 3143 counties in order of median property taxes. Grand County Property Tax Exemptions httpscograndcous160Forms View Grand County Colorado property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions applications and program details.

Adams County Wi Public Land Wildlife Areas Hunting

Adams County Government Center Adams County Government

Hs Community Resources Adams County Government

2022 Elections Battlegrounds To Watch Adams County Colorado Politico

Opportunity Zones Map Adams County Government

Adams County Inquires About State Oversight Of County Treasurers After Suing Its Own

Career Opportunities Sorted By Job Title Ascending

Floods Adams County Government

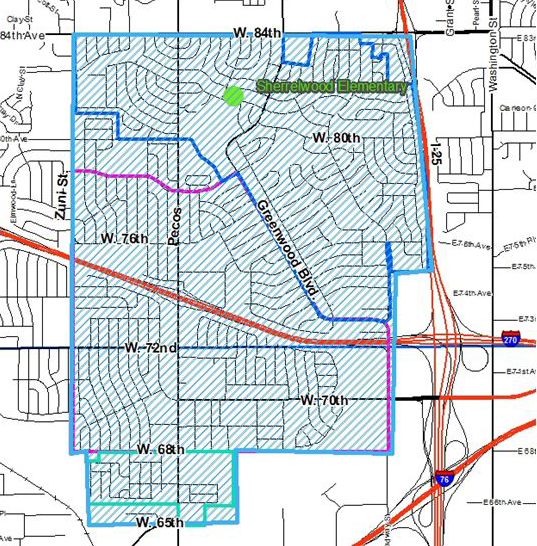

Sherrelwood Community Snapshot Adams County Government

Adams County Wi Atving Utv Atv Routes Trails Maps

Adams County Motor Vehicle Offices Closing Thursday Nov 19 Adams County Government